In this article, we will describe a guideline in EU Tax configuration for Magento 2 store based in France that sells >100k Euros in France and > 100k Euros in Germany.

- Tax calculations are managed at the website level.

- Currency conversion and tax display options are controlled individually at the store view level (Click the Use Website checkbox to override the default).

- You can dynamically show the correct tax for the jurisdiction by setting the default tax country.

- Fixed product tax is included for material goods as a product attribute.

- To ensure that it shows up in the correct category/website/store view, it might be necessary to edit the catalog.

Step 1: Create Three Product Tax Classes

In this example, the multiple VAT-Reduced product tax classes are unecessary.

- Create a VAT-Standard product tax class.

- Create a VAT-Reduced product tax class.

- Create a VAT-Free product tax class.

Step 2: Create Tax Rates for France and Germany

Create the following tax rates:

Tax Rates

| TAX RATE | SETTING | ||||||||

| France-Standard VAT |

|

||||||||

| France-Reduced VAT |

|

||||||||

| Germany-Standard VAT |

|

||||||||

| Germany-Reduced VAT |

|

Step 3: Set Up the Tax Rules

Create the following tax rules:

Tax Rules

| TAX RULE | SETTING | ||||||||||

| Retail-France-Standard VAT |

|

||||||||||

| Retail-France-Reduced VAT |

|

||||||||||

| Retail-Germany-Standard VAT |

|

||||||||||

| Retail-Germany-Reduced VAT |

|

Step 4: Set Up a Store View for Germany

On the admin sidebar click Stores > All Stores

Create a store view for Germany. Follow these steps:

- Stores > Configuration. Set Default Config to the French store.

- On General Page, open the Countries Options tab and set the default country to “France.”

- Complete the locale options as needed.

In the upper-left corner, choose the German Store View and follow these steps:

- On the General page, open Countries Options, and set the default country to “Germany.”

- Complete the locale options as needed.

Step 5: Configure Tax Settings for France

Complete the following General tax settings:

General Settings

| FIELD | RECOMMENDED SETTING |

| TAX CLASSES | |

| Tax Class for Shipping | Shipping (shipping is taxed) |

| CALCULATION SETTINGS | |

| Tax Calculation Method Based On | Total |

| Tax Calculation Based On | Shipping Address |

| Catalog Prices | Including Tax |

| Shipping Prices | Including Tax |

| Apply Customer Tax | After Discount |

| Apply Discount on Prices | Including Tax |

| Apply Tax On | Custom Price (if available) |

| DEFAULT TAX DESTINATION CALCULATION | |

| Default Country | France |

| Default State | |

| Default Postal Code | * (asterisk) |

| SHOPPING CART DISPLAY SETTINGS | |

| Include Tax in Grand Total | Yes |

| FIXED PRODUCT TAXES | |

| Enable FPT | Yes |

| All FPT Display Settings | Including FPT and FPT description |

| Apply Discounts to FPT | No |

| Apply Tax to FPT | Yes |

| Include FPT in Subtotal | Yes |

Step 6: Configure Tax Settings for Germany

Click Stores > Configuration. In the upper-right corner, set Store View to the view to the German store and click OK. On the left of the panel under Sales, click Tax.

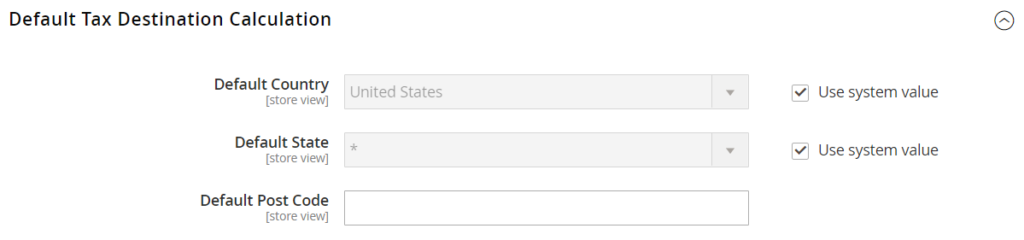

In the Default Tax Destination Calculation tab, follow these steps:

- Default Country

- Default State

- Default Post Code

This setting ensures that tax is calculated correctly when product prices include tax.

Click Save Config.